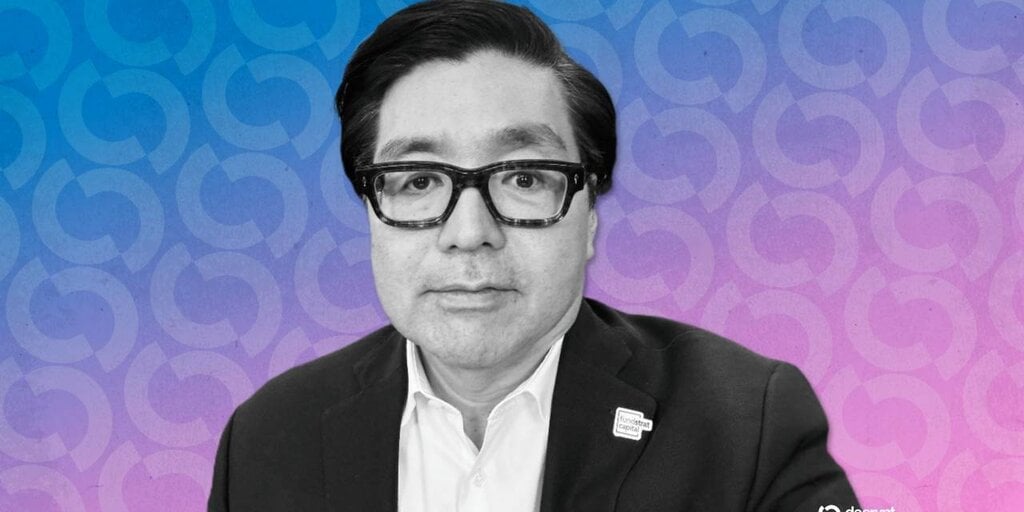

Tom Lee, co-founder of Fundstrat Global Advisors, makes waves in the crypto world once again as BitMine shares skyrocket following a timely Ethereum purchase during a market dip. This move highlights his investment expertise and the growing confidence in Ethereum's position within decentralized finance and blockchain innovation.

Tom Lee's BitMine Shares Spike After Strategic Ethereum Buy

Estimated Reading Time: 5 minutes

Turning Opportunity into Success: A Strategic Cryptocurrency Investment

Tom Lee, co-founder and head of research at Fundstrat Global Advisors, is no stranger to the crypto market. Today, his strategic vision has earned him and his company BitMine the spotlight once again. Following a calculated purchase of Ethereum (ETH) during a market downturn, BitMine’s shares saw a remarkable surge, leaving investors confident and optimistic.

Understanding the Move: Why Buy Ethereum During a Dip?

Ethereum, the world's second-largest cryptocurrency by market capitalization, recently experienced a decline in price—a moment that made many retail and institutional investors hesitant. However, Tom Lee’s swift actions demonstrated his trust in Ethereum’s long-term value, particularly in its widespread use across DeFi projects and smart contract functionalities.

Key factors that influenced Lee's decision:

- A growing utility in decentralized finance (DeFi) and NFT sectors

- Upcoming scalability advancements, including the transition to Proof-of-Stake (PoS)

- Ethereum roadmaps like the ‘Merge' and Layer 2 solutions reducing costs

Lee’s strategic mindset aligned perfectly with prevailing market sentiments, leading to a ripple effect as other investors followed suit, resulting in increased trading volumes globally.

Impacts of the Ethereum Strategy on BitMine

BitMine's proactive move to capitalize on the market dip has dramatically boosted investor confidence. The company's shares surged, showcasing the potential gains from embracing calculated cryptocurrency investments. Industry analysts are already viewing this as a pivotal moment for BitMine as it increasingly integrates into the Ethereum ecosystem and blockchain innovation framework.

Lee’s sentiments on the long-term potential of Ethereum emphasize this idea. In his own words:

‘Ethereum's fundamentals remain solid, with growing utility in DeFi and NFT sectors, alongside scalability improvements like the transition to Proof-of-Stake (PoS). Timing the dip has only reinforced our belief in its potential.'

The Broader Impact: Lessons for Investors

Market experts agree that Lee's move sets a blueprint for agile and strategic investing in the dynamic crypto space. While Ethereum’s value temporarily dipped, its central role in blockchain technology’s advancement continues to attract institutional interest.

Takeaways for investors:

- Short-term dips often serve as springboards for long-term gains

- Understanding market dynamics is key to calculated decision-making

- Cryptocurrencies like Ethereum represent not only speculative items but also transformative business tools

Final Thoughts: Bold Decisions in a Maturing Crypto Market

Tom Lee’s recent Ethereum acquisition demonstrates the importance of understanding timing and market sentiment. The growth in BitMine shares reflects the ripple effect of one strategic decision, highlighting the opportunities available for those bold enough to act. As the crypto market evolves, leaders like Lee will undoubtedly continue setting examples for how to embrace the disruptive potential of blockchain technologies.

For both individual investors and companies alike, this story underscores the value of treating digital assets as essential components of long-term business strategies rather than mere speculative tools. The question remains: Are others ready to follow this lead?